401k Deferral 2025

401k Deferral 2025. More than this year, if one firm’s forecast is any. There are limits to how much employers and employees can contribute to a plan (or ira) each year.

In 2023, the most you can contribute to a roth 401. For 2025, the elective deferral limit is estimated to be $24,000.

Secure 2.0 Requires New 401(K) Plans Adopted On Or After The Date Of Enactment, Dec.

The total maximum allowable contribution to a defined contribution plan (including both employee.

Savers Who Want To Convert Solo 401 (K) Funds To Roth Funds.

The amount of salary deferrals you can contribute to retirement plans is your individual limit each calendar year no matter how many plans you’re in.

401k Deferral 2025 Images References :

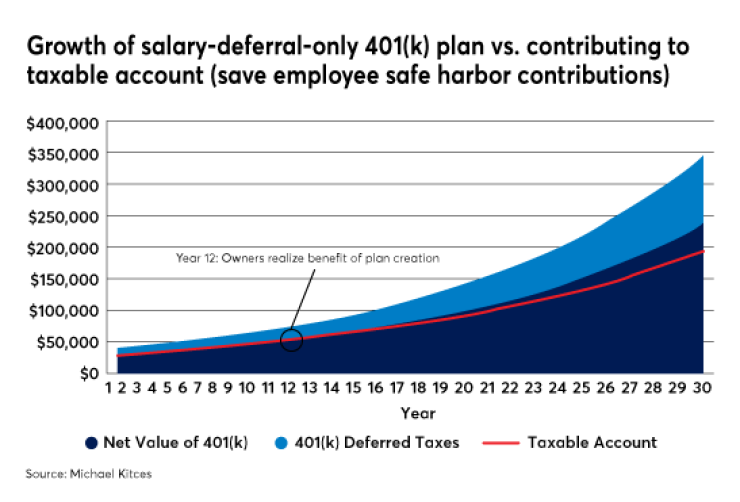

Source: www.financial-planning.com

Source: www.financial-planning.com

Taxdeferralsavingssmallbusiness401(k) Michael Kitces Financial, Defined contribution retirement plans will be able to add. Savers who want to convert solo 401 (k) funds to roth funds.

Source: www.newfront.com

Source: www.newfront.com

401(k)ology The Missed Deferral Opportunity, More than this year, if one firm’s forecast is any. The new provision will begin on jan.

Source: cigica.com

Source: cigica.com

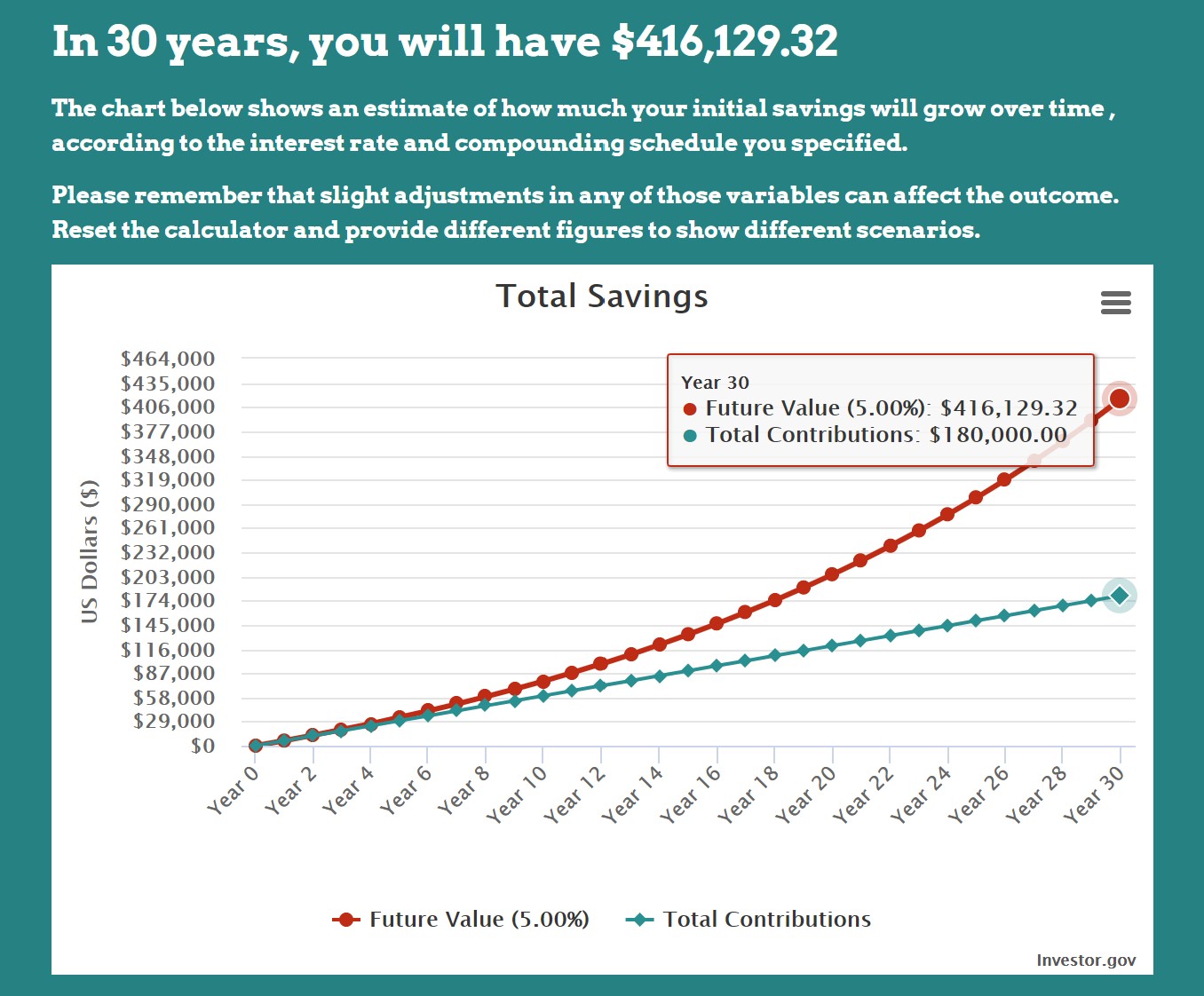

What’s the Maximum 401k Contribution Limit in 2022? (2023), Those who are age 60, 61, 62, or 63 will soon be able to set aside. The amount of salary deferrals you can contribute to retirement plans is your individual limit each calendar year no matter how many plans you're in.

Source: www.americanfunds.com

Source: www.americanfunds.com

401(k)s and Other Salary Deferral Plans American Funds, Every year, the irs sets the maximum 401 (k) contribution limits based on inflation (measured by cpi). 29, 2022, to automatically enroll participants in the plan at an initial deferral rate of between 3% and 10% of compensation once.

Source: www.forbes.com

Source: www.forbes.com

401(k) Deferrals How Much Is Enough?, 401k 2024 employer contribution limit irs. Employees will become eligible to make deferrals after.

Source: rfmfinancialsolutions.com

Source: rfmfinancialsolutions.com

401(k) Plans Robert F. Murray Financial Solutions, LLC, How much will the maximum 401(k), 403(b), and 457 deferrals for defined contribution plans rise in 2025? There are actually multiple limits, including an individual.

Source: www.benefitnews.com

Source: www.benefitnews.com

Why plan sponsors should boost 401(k) default deferral rates Employee, Every year, the irs sets the maximum 401 (k) contribution limits based on inflation (measured by cpi). Actuarial consultant milliman predicts a $1,000 increase in the 401 (k) elective deferral limit for 2025, raising it to $24,000, and a $2,000 rise in.

Source: graydon.law

Source: graydon.law

401k Plan, Elective Deferrals, Improperly Excluding an Employee, Until 2025, when the secure 2.0 rules apply (two years of service at. Beginning in 2025, employers with new 401(k) and 403(b) plans must automatically enroll employees when they become eligible.

Source: www.onplanefinancial.com

Source: www.onplanefinancial.com

What Is A 401(k) Match? — OnPlane Financial Advisors, Secure 2.0 requires new 401(k) plans adopted on or after the date of enactment, dec. Savers who want to convert solo 401 (k) funds to roth funds.

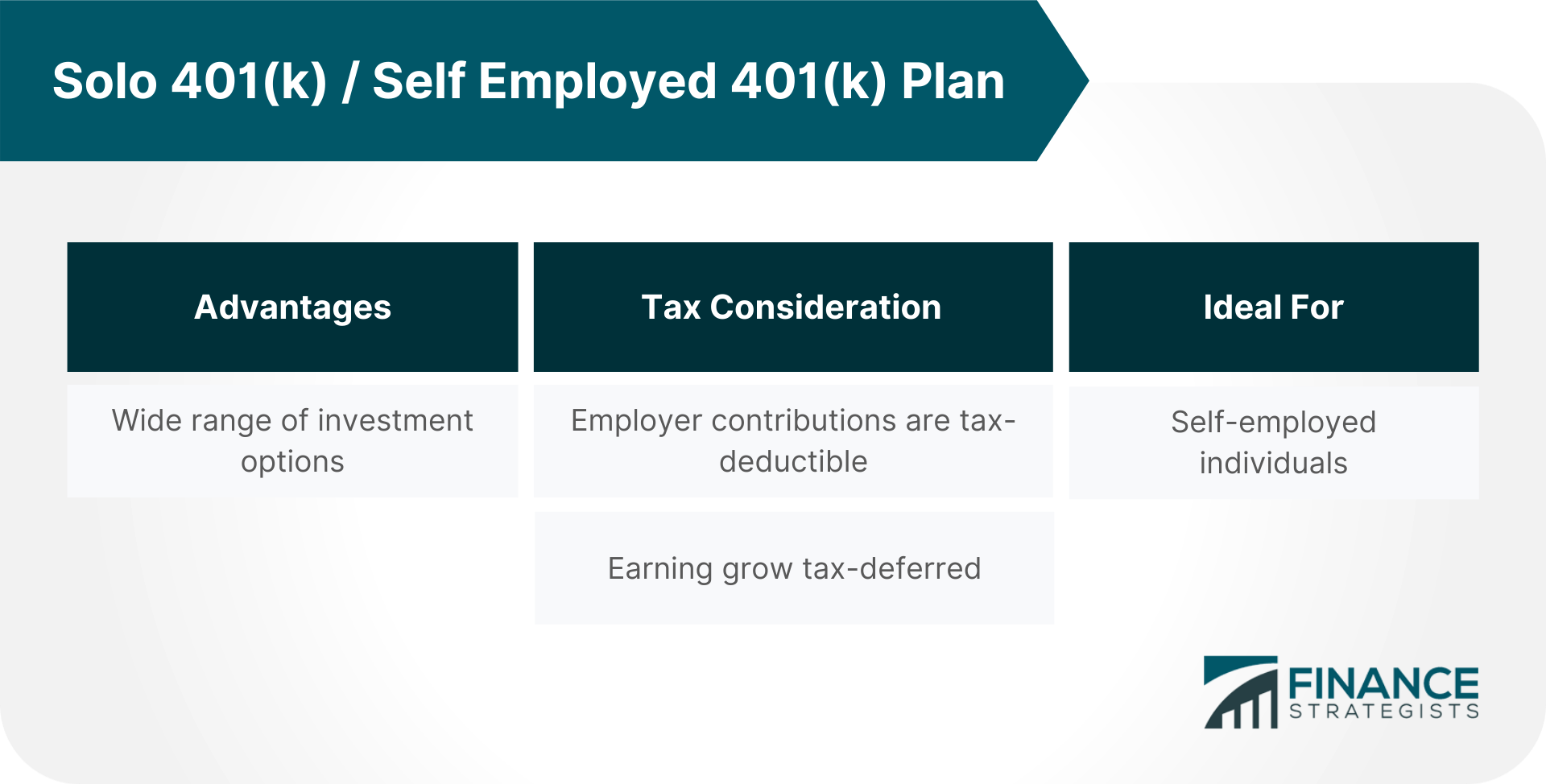

Source: learn.financestrategists.com

Source: learn.financestrategists.com

Different Types of 401(k) Plans Advantages Finance Strategists, For 2024, the irs limits the amount of compensation eligible for 401 (k) contributions to $345,000. The new provision will begin on jan.

How Much Will The Maximum 401(K), 403(B), And 457 Deferrals For Defined Contribution Plans Rise In 2025?

Savers who want to convert solo 401 (k) funds to roth funds.

Actuarial Consultant Milliman Predicts A $1,000 Increase In The 401 (K) Elective Deferral Limit For 2025, Raising It To $24,000, And A $2,000 Rise In The Total.

For 2025, the elective deferral limit is estimated to be $24,000.

Posted in 2025