403b Contribution Limit 2024

403b Contribution Limit 2024. 2024 irs 403b contribution limits. What is the 403b contribution limit for 2024?

What is the 403b contribution limit for 2024? If you are under age 50, the annual contribution limit is $23,000.

This Means That For Savers Under 50, You Can Defer $23,000 Per Year, Or A Total Combined $69,000.

403(b) contribution limits in 2023 and 2024.

If You're 50 Or Older, You Can Contribute An.

The limit that may be deferred for 2024, as determined by the internal revenue service, is:

Workers Can Contribute Up To $23,000 Of Their Income To A 403 (B) Plan, With An Additional $7,500 Allowed For Workers 50 And Older.

Images References :

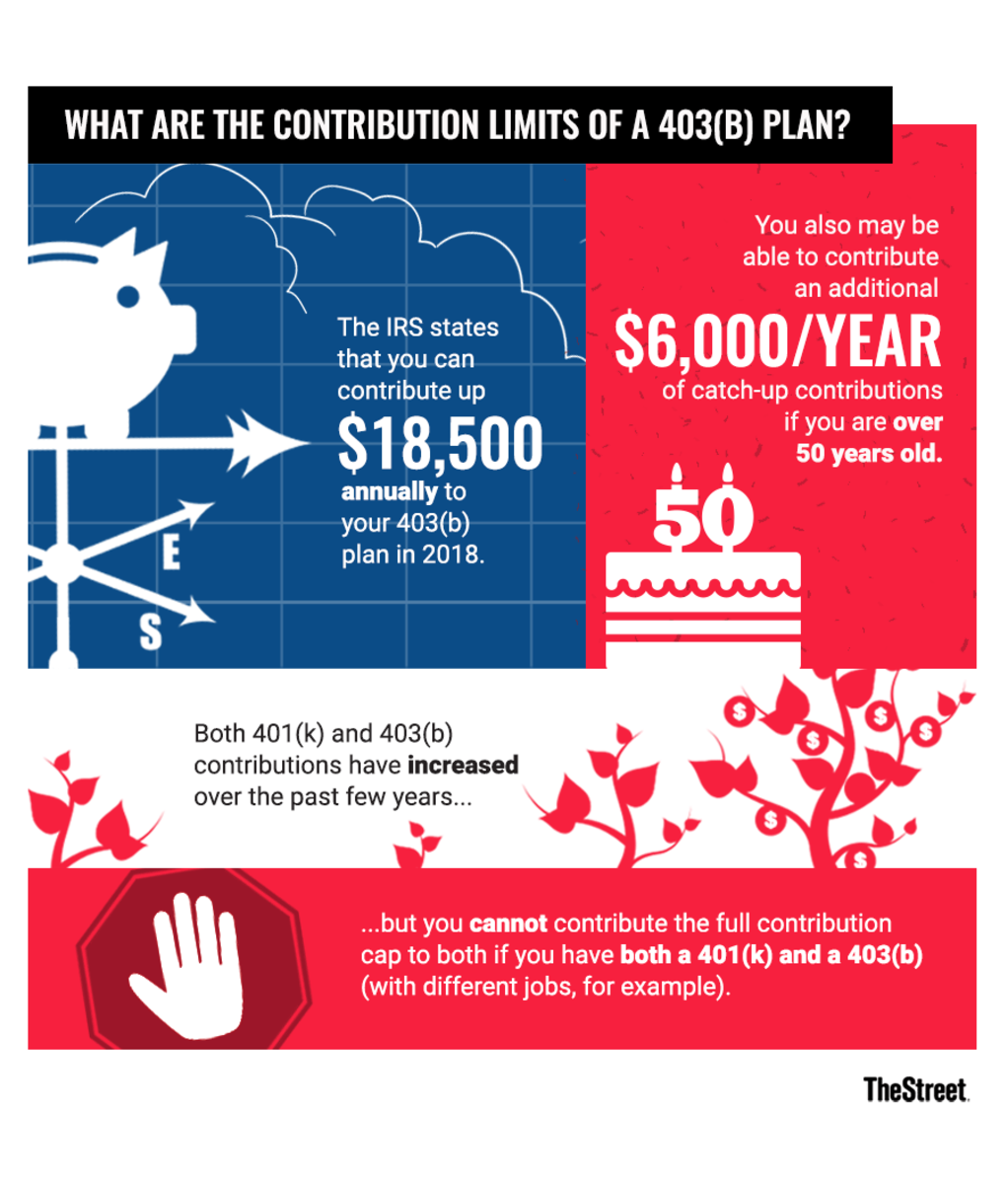

Source: www.thestreet.com

Source: www.thestreet.com

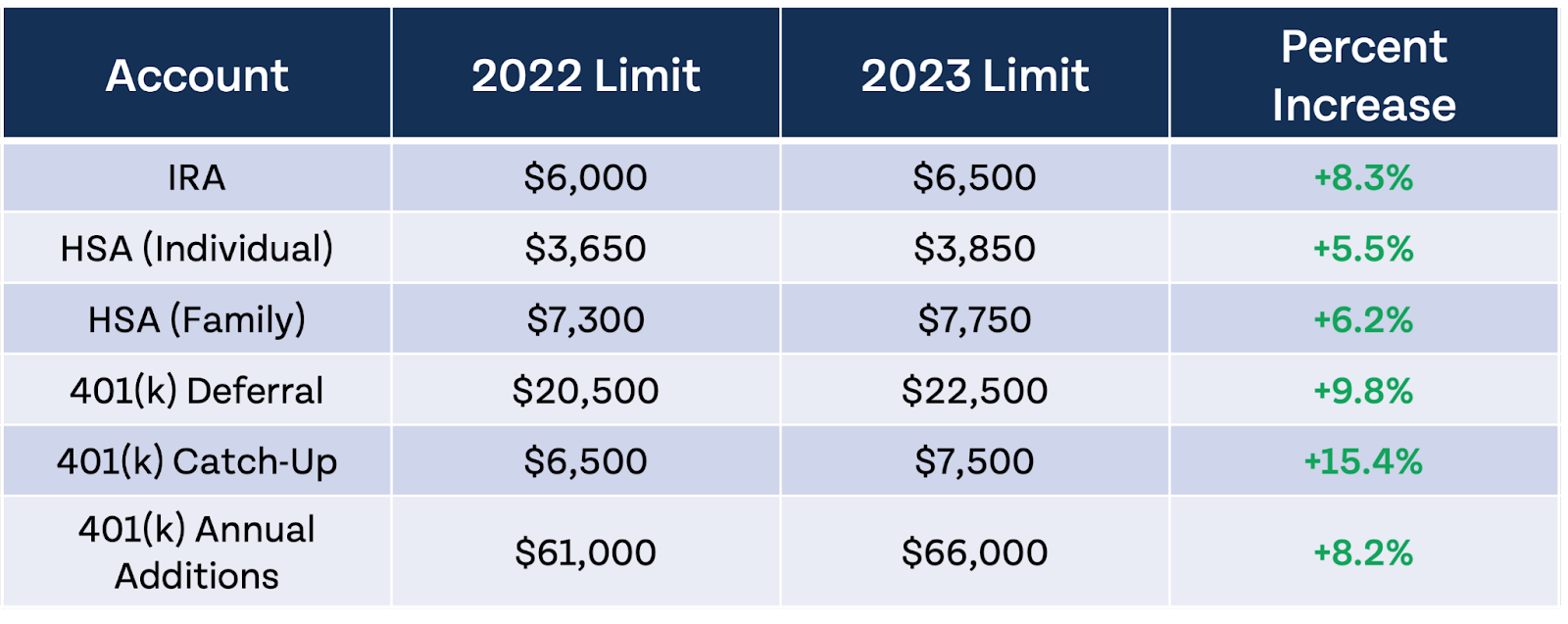

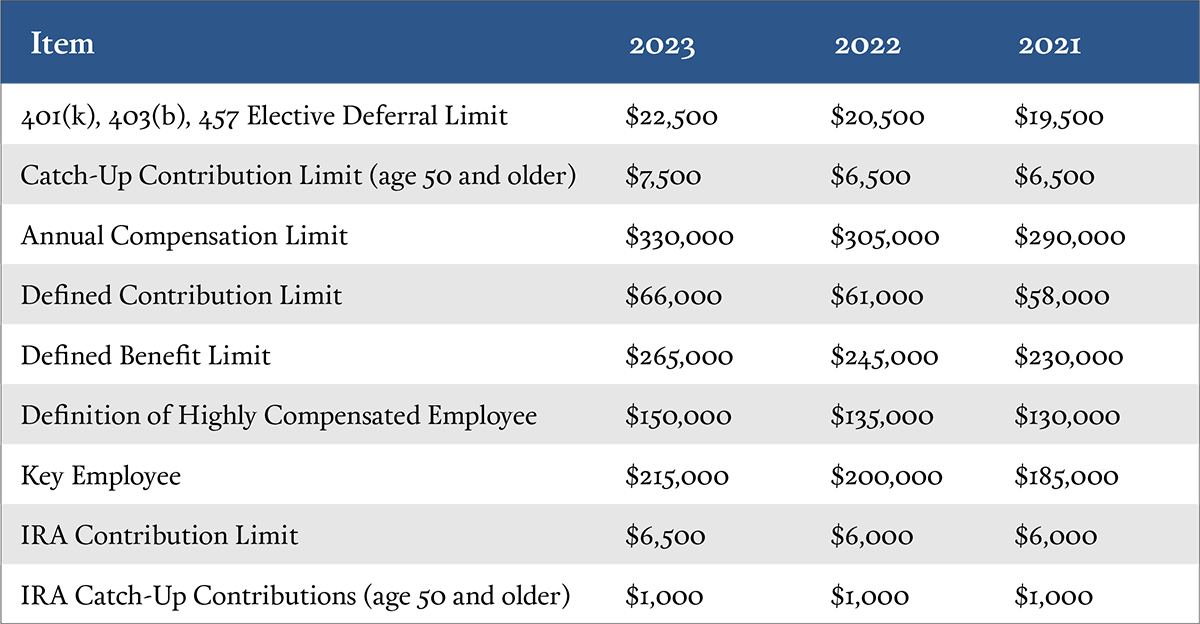

What Is a 403(b) Plan and How Do You Contribute? TheStreet, 2024 401 (k) and 403 (b) contributions limits. Your contribution and your employer’s contributions.

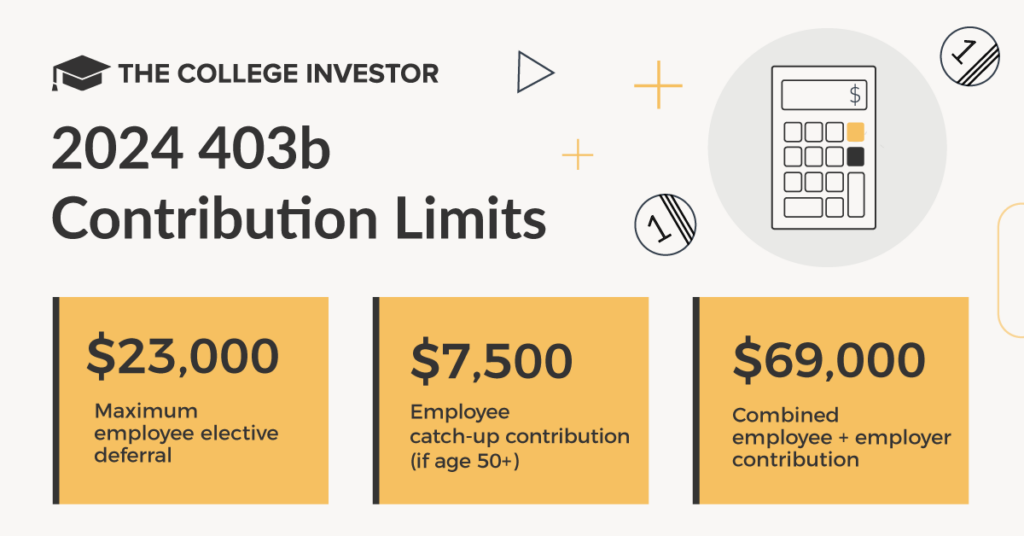

Source: thecollegeinvestor.com

Source: thecollegeinvestor.com

403(b) Contribution Limits For 2023 And 2024, If you're 50 or older, you can contribute an. The total employee contribution limit to.

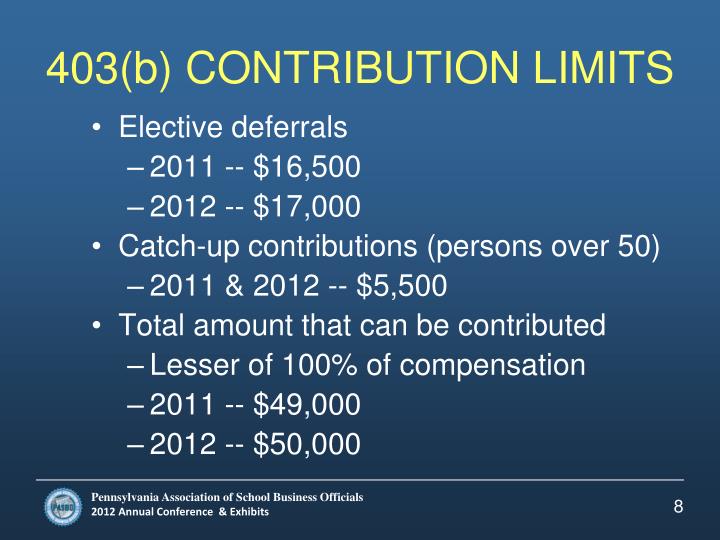

Source: www.slideserve.com

Source: www.slideserve.com

PPT Avoiding IRS Penalties Understanding Constructive Receipt, Starting in 2024, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs. Roth 403b contribution limits 2024.

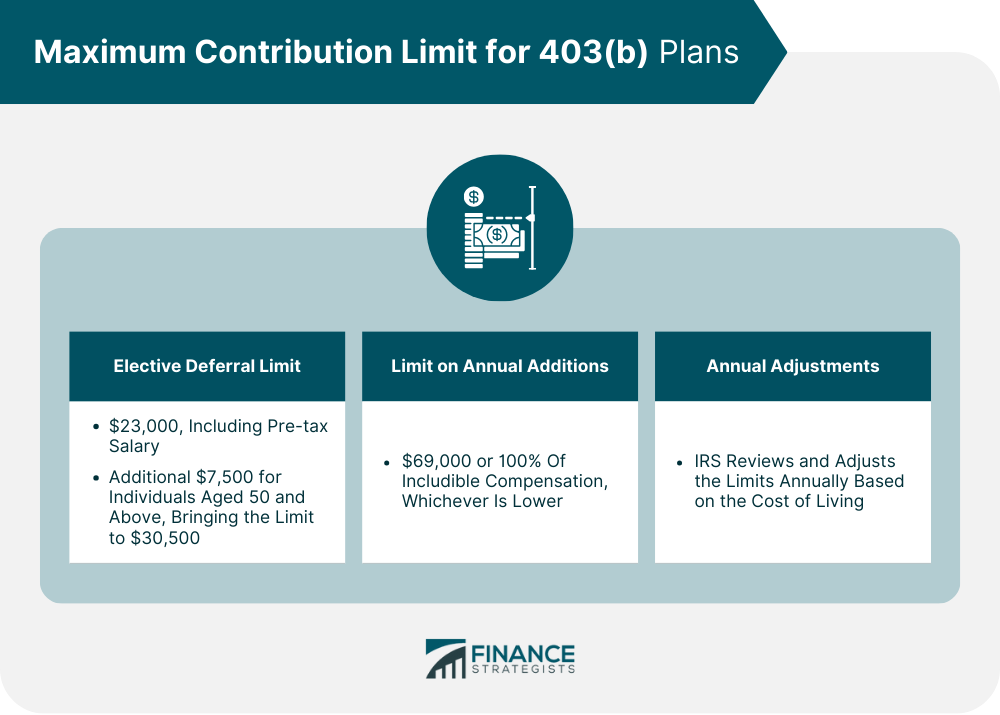

Source: www.financestrategists.com

Source: www.financestrategists.com

Maximum 403(b) Contribution Limits, Factors, and Strategies, Here are some of the most frequently asked questions about 403(b) plans and contribution limits. This contribution limit increases to $23,000 in 2024.

Source: choosegoldira.com

Source: choosegoldira.com

401k contribution limits 2022 Choosing Your Gold IRA, 2023 403 (b) contribution limits. 403(b) contribution limits in 2023 and 2024.

Source: fyi.moneyguy.com

Source: fyi.moneyguy.com

The IRS Just Announced 2023 Tax Changes!, 403(b) contribution limits consist of two parts: Starting in 2024, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs.

_and_403(b)_Plans_Work.png?width=1680&height=839&name=How_Do_401(a)_and_403(b)_Plans_Work.png) Source: www.carboncollective.co

Source: www.carboncollective.co

401(a) vs. 403(b) Similarities, Differences, Advantages, & Limits, Maximum salary deferral for workers. Combined contribution limit for 401k, 403b & 457b for 2024.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, If you are age 50 or older in. On your end, you can defer up to $23,000 from your salary to your 403(b) in 2024.

Source: aegisretire.com

Source: aegisretire.com

IRS Limits 2023 Archives Aegis Retirement Aegis Retirement, For workers age 50+ in 2024, the contribution limit is $30,500: In 2024, the internal revenue service has increased the maximum contribution limit for 401(k) plans to $23.

_and_403(b)_Plans_Work_(1).png?width=2400&height=1300&name=How_Do_401(a)_and_403(b)_Plans_Work_(1).png) Source: www.carboncollective.co

Source: www.carboncollective.co

401(a) vs. 403(b) Similarities, Differences, Advantages, & Limits, The annual contribution limit for iras has also. The maximum 403(b) contribution for 2024 is $23,000.

The Limits For 2024 Are As Follows:.

The total employee contribution limit to all 401(k) and 403(b) plans for those under 50 will be going up from.

If You Exceed This Contribution.

If you are under age 50, the annual contribution limit is $23,000.